5 Simple Techniques For Offshore Banking

3%, some offshore financial institutions can obtain upwards of 3-4%, though this could not enough reason alone to financial institution within the territory, it does tell you that not all financial systems were produced equal. 4. International Banks Have a Safer Financial System, It is necessary to make certain your properties are saved in a Placing your riches in a safe and secure, and also a lot more importantly, time-tested financial system is incredibly important.

The large commercial financial institutions really did not also come close. International financial institutions are much safer option, for one, they need greater capital books than several financial institutions in the US and UK. While lots of financial institutions in the UK as well as US require approximately just 5% books, several global banks have a much greater resources get proportion such as Belize as well as Cayman Islands which have on ordinary 20% and 25% specifically.

The quickest method to avoid this from taking place is to establish a worldwide checking account in an abroad jurisdiction account that is outside the reach of the federal government. 6 - offshore banking. Making Use Of a Financial System that is Safe and also Has Sound Economic Plans in your home country. Some overseas banks, for instance, do not lead out any kind of money as well as keep 100% of all down payments handy.

Offshore Banking Fundamentals Explained

While several domestic accounts restrict your capacity in holding other money denominations, accounts in Hong Kong or Singapore, as an example, enable you to have upwards of a lots money to picked from all in simply one account. 8. International Accounts Provides You Greater Asset Security, It pays to have well-protected funds.

Without any kind of access to your possessions, exactly how can you protect yourself in court? Money and also assets that are maintained offshore are much harder to take due to the fact that foreign federal governments do not have any type of territory and also consequently can not compel financial institutions to do anything. Regional courts and also governments that regulate them only have actually limited impact (offshore banking).

It's not if - it's when. In the US, there are over 40 million new claims filed every year, with 80% of the world's lawyers staying in the U.S.A., that is not too surprising. If you are hit with a legal action you can be basically reduced off from all your possessions prior to being brought to trial.

Some Known Factual Statements About Offshore Banking

Be sure to examine your countries arrangements and also if they are a signatory for the Usual Reporting System (CRS). With an offshore LLC, Limited Firm or Count on can offer an action of discretion that can not be discovered in any kind of personal domestic account. Banks do have a rate of interest in maintaining private the names and details of their clients as in areas like Panama where privacy is militantly preserved, however, Know Your Client (KYC) rules, the CRS and also the OECD have actually radically improved financial privacy.

Using candidate supervisors can also be utilized to develop another layer of safety that removes your name from the paperwork. This still does not make you totally anonymous it can offer layers of safety and security as well as personal privacy that would certainly or else not be feasible. Takeaway, It is never ever too late to develop a Fallback.

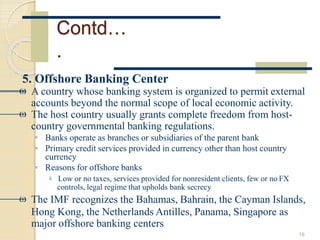

What Is Offshore? The term offshore describes an area outside of one's house country. The term is frequently utilized in the banking and financial sectors to explain locations where regulations are different from the residence nation. Offshore places are normally island countries, where entities establish corporations, investments, as well as deposits.

8 Simple Techniques For Offshore Banking

Boosted pressure is causing even more reporting of international accounts to international tax authorities. Recognizing Offshore Offshore can refer to a range of foreign-based entities, accounts, or various other financial services. In order to certify as offshore, the task taking place needs to be based in a nation besides the business or investor's home nation.

Offshoring isn't generally illegal. Concealing it is. Unique Factors to consider Offshoring is perfectly legal since it supplies entities with a lot of privacy and privacy. However authorities are worried that OFCs are being made use of to stay clear of paying tax obligations. Because of this, there is enhanced pressure on these countries to report foreign holdings to worldwide tax authorities.

Types of Offshoring There are several kinds of offshoring: Service, investing, and also banking. This is the act of developing specific business functions, such as production or phone call facilities, in a nation various other than where the company is headquartered.

Offshore Banking for Beginners

Companies with considerable sales overseas, such as Apple and also Microsoft, might seize the day to maintain relevant profits in overseas accounts in nations with lower tax problems. Offshore Spending Offshore spending can entail any circumstance in which the overseas capitalists reside outside the nation in which they spend. This technique is mostly utilized by high-net-worth financiers, as running offshore accounts can be specifically high.

Offshore financiers may likewise be inspected by regulators and tax obligation authorities to make certain taxes are paid.

Offshore jurisdictions, such as the Bahamas, Bermuda, Cayman Islands, as well as the Isle of Male, are preferred as well as known to offer fairly secure financial investment possibilities. Advantages and Disadvantages of Offshore Spending While we have actually noted some typically approved pros as well as cons of going offshore, this area considers the advantages as well as drawbacks of overseas investing.

The Best Strategy To Use For Offshore Banking

This suggests you can be on the hook if you don't report your holdings. Make sure you select a trustworthy broker or investment expert to make sure that your cash is dealt with appropriately.

more info here click site over here